Donate

The Norfolk Area Community Foundation Fund is committed to giving back to the Norfolk community. The generosity of awesome donors (like you!) gets pooled together to create a powerful gift of grants for our community. Your donation to our Unrestricted Endowment will help support the whole community through grant opportunities for the emerging needs in the Norfolk area. Thanks to your generous contribution, you will continue to help enhance Norfolk both now and for years to come.

Through grants and partnerships, we have provided financial support to various community projects and programs. Here are a few examples:

- Embrace Park, an all-inclusive playground and splash pad

- Mayor’s Diversity Council

- Norfolk Youth Theatre

- Norfolk Public Schools, Career Exploration

- Project Homeless Connect

- Animal Shelter of Northeast Nebraska

- Norfolk Sculpture Walk

- Norfolk Arts Center

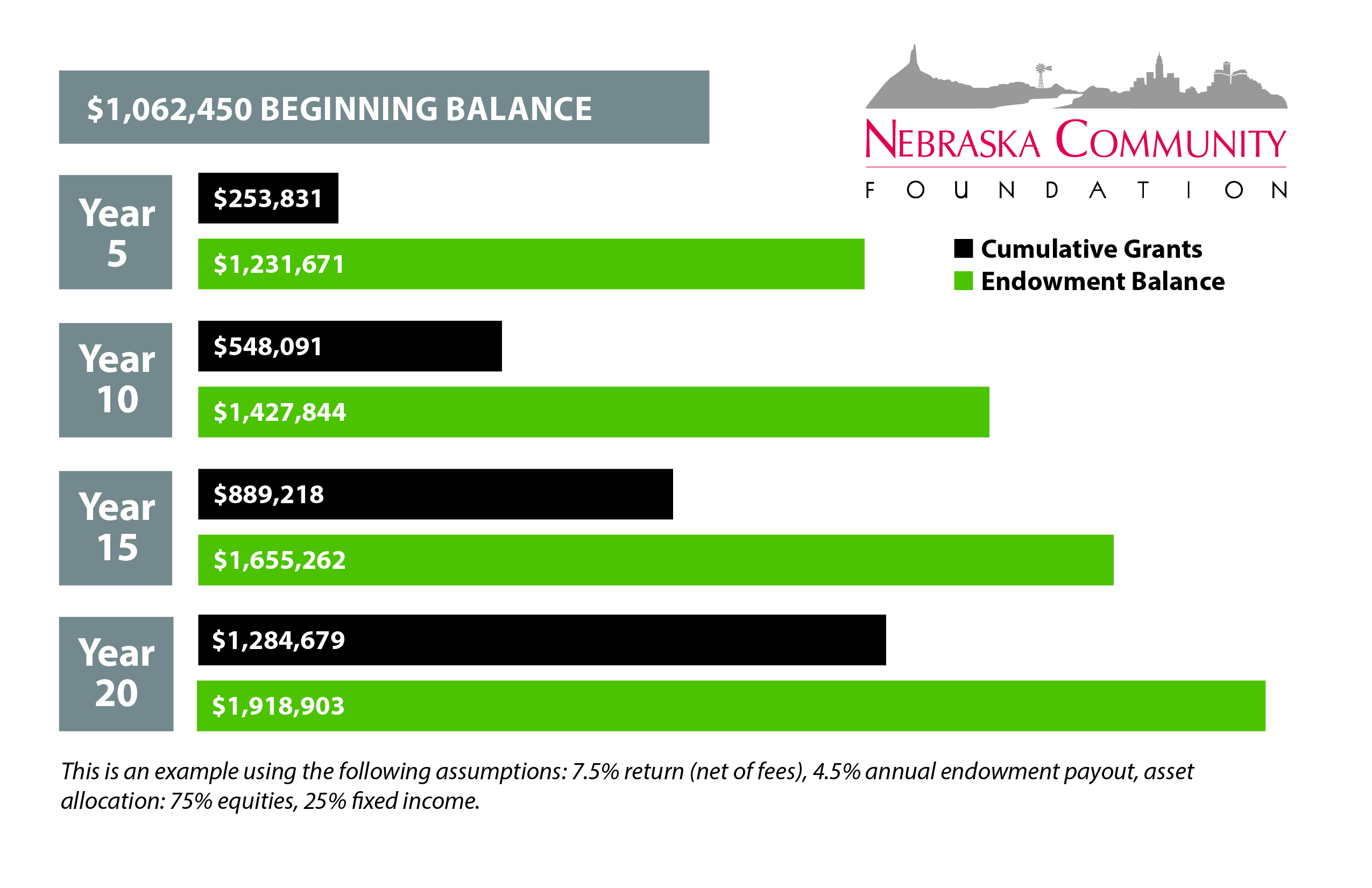

Endowment

Ways to Give

CASH

A gift of cash may be eligible for income tax deductions as prescribed by current law. Your cash gift may be by check, credit card or electronic funds transfer, which authorizes the automatic transfer of funds each month from your checking or savings account. Pledging a gift over several years may allow you to increase its size and effect, while adjusting the timing and amount of each payment to optimize your tax position.

MARKETABLE SECURITIES

A gift of publicly-traded stock, bonds or mutual fund shares is eligible to be matched and may provide you with additional tax benefits, as you will not pay capital gains tax on the appreciation in the value of the securities.

GIFTS OF IRA

Individuals who have reached age 70½ may contribute up to $100,000 directly from their Individual Retirement Account (IRA), without having to recognize the IRA distribution as taxable income. If married, each spouse can transfer up to $100,000 from his or her IRA each year.

AGRICULTURAL COMMODITIES

Gifts of grain or livestock may provide significant income tax savings to a producer.